what is maryland earned income credit

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current. Have investment income below 10000 in the tax year 2021.

Revised Maryland Individual Tax Forms Are Ready

The state EITC reduces the amount of Maryland tax you.

. Thestate EITCreducesthe amount of Maryland tax you owe. The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. Ad Prevent Tax Liens From Being Imposed On You.

Most of the time that means taxpayers. R allowed the bill to take effect without his signature. Ad File 1040ez Free today for a faster refund.

The state EITC reduces the amount of Maryland tax you. If you qualify you can use the credit to reduce the taxes you owe. The earned income tax credit EITC is a refundable tax credit that helps certain US.

If you qualify for the federal earned income tax credit and claim it on your federal. Expansion of the Earned Income Credit SB218 was enacted under Article II Section 17b of the Maryland Constitution. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. To qualify for the EITC you must. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

Taxpayers with low earnings by reducing the amount of tax owed on a dollar-for-dollar basis. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. In 2019 25 million taxpayers received.

Ad Receive you refund via direct deposit. The Earned Income Credit EIC otherwise known as Earned Income Tax Credit EITC is a valuable credit for low-income taxpayers who work and earn an income of a certain amount. The earned income tax credit is aptly named.

CPA Professional Review. Maximize Your Tax Refund. Have worked and earned income under 57414.

DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The bills purpose is to expand the numbers of taxpayers to whom the.

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. The most important eligibility requirement is having some form of earned income. Have a valid Social Security.

Which State Do You Belong In Based On The Life You Plan For Yourself Social Security Benefits The Motley Fool Social Security

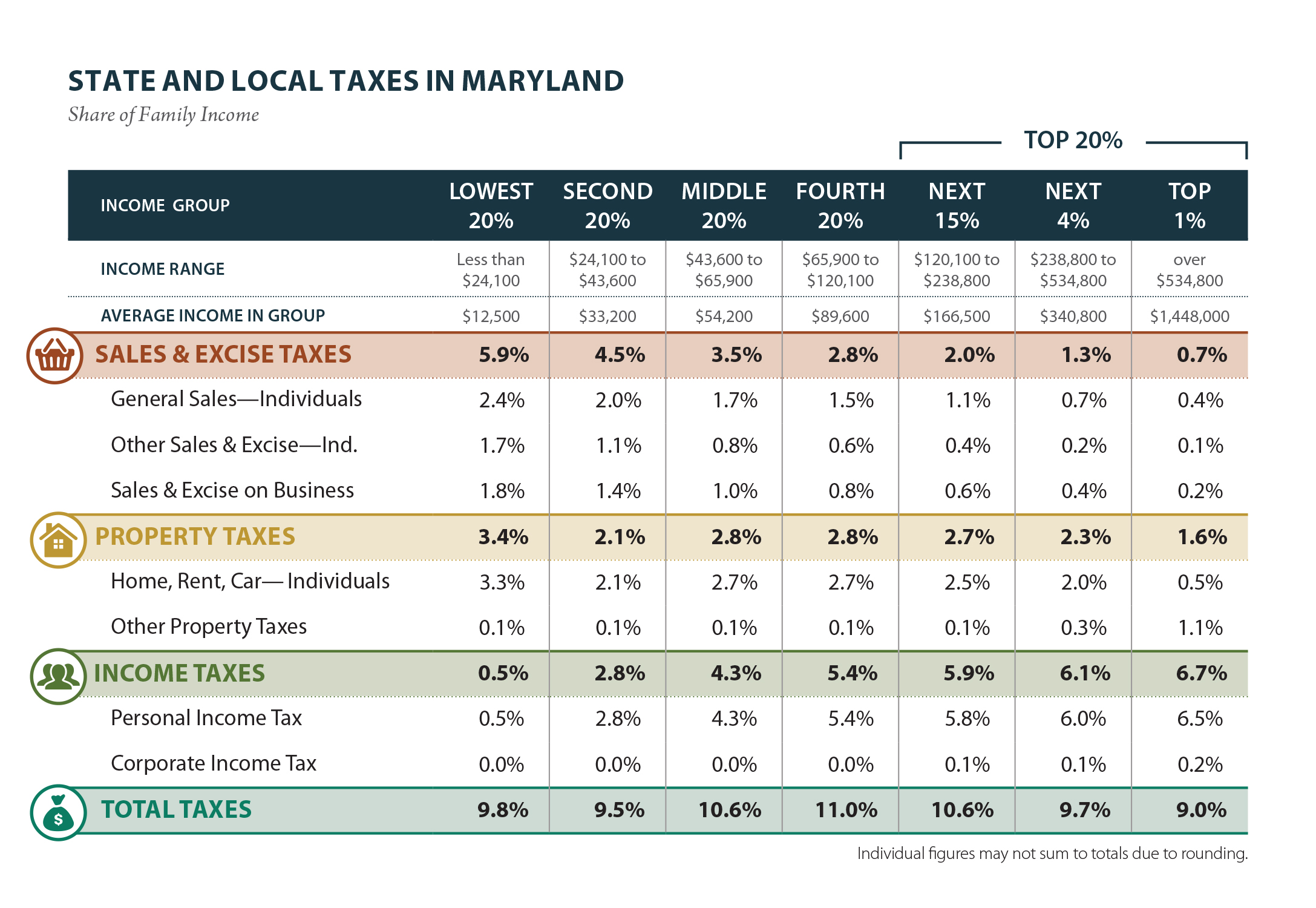

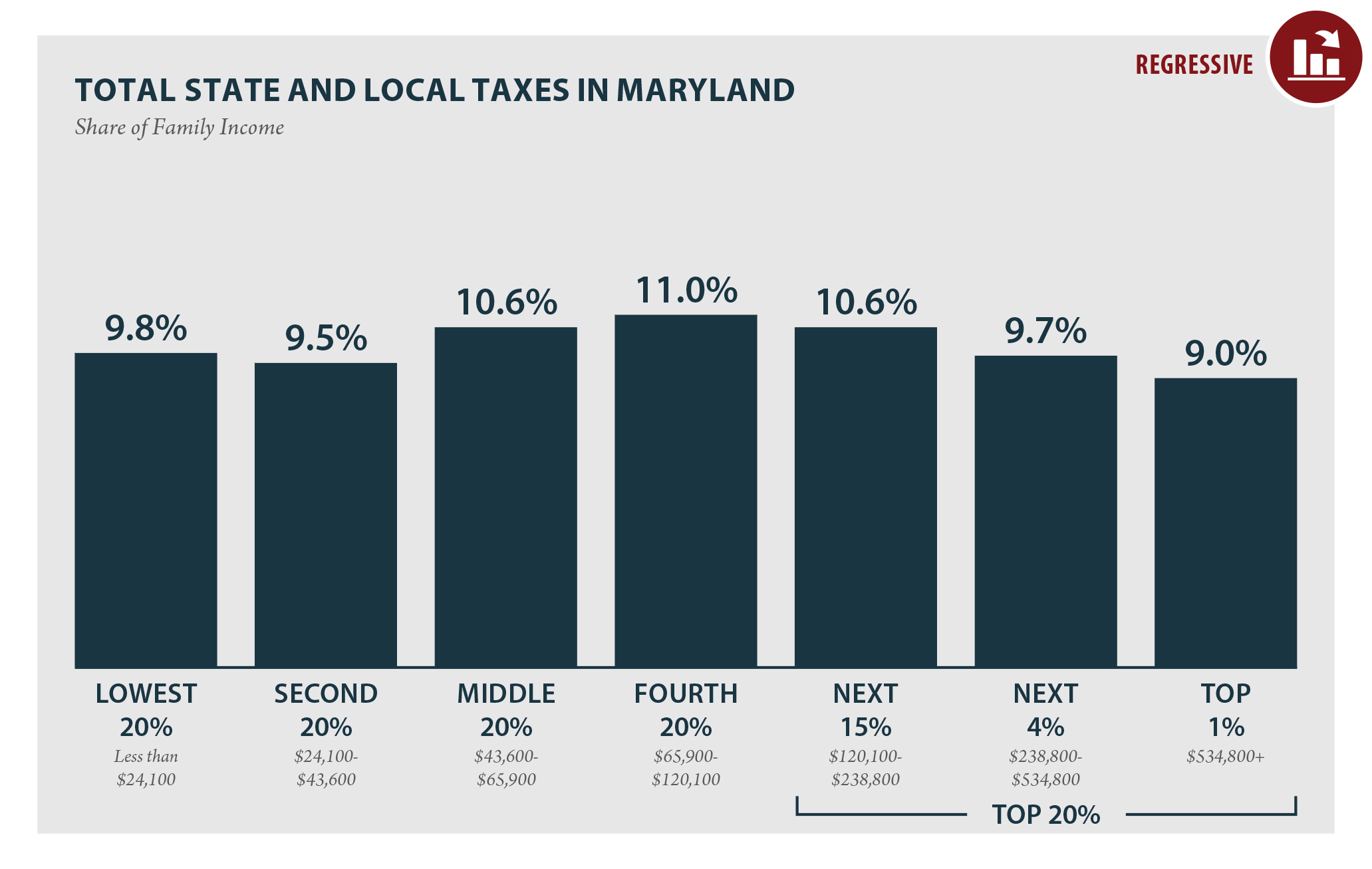

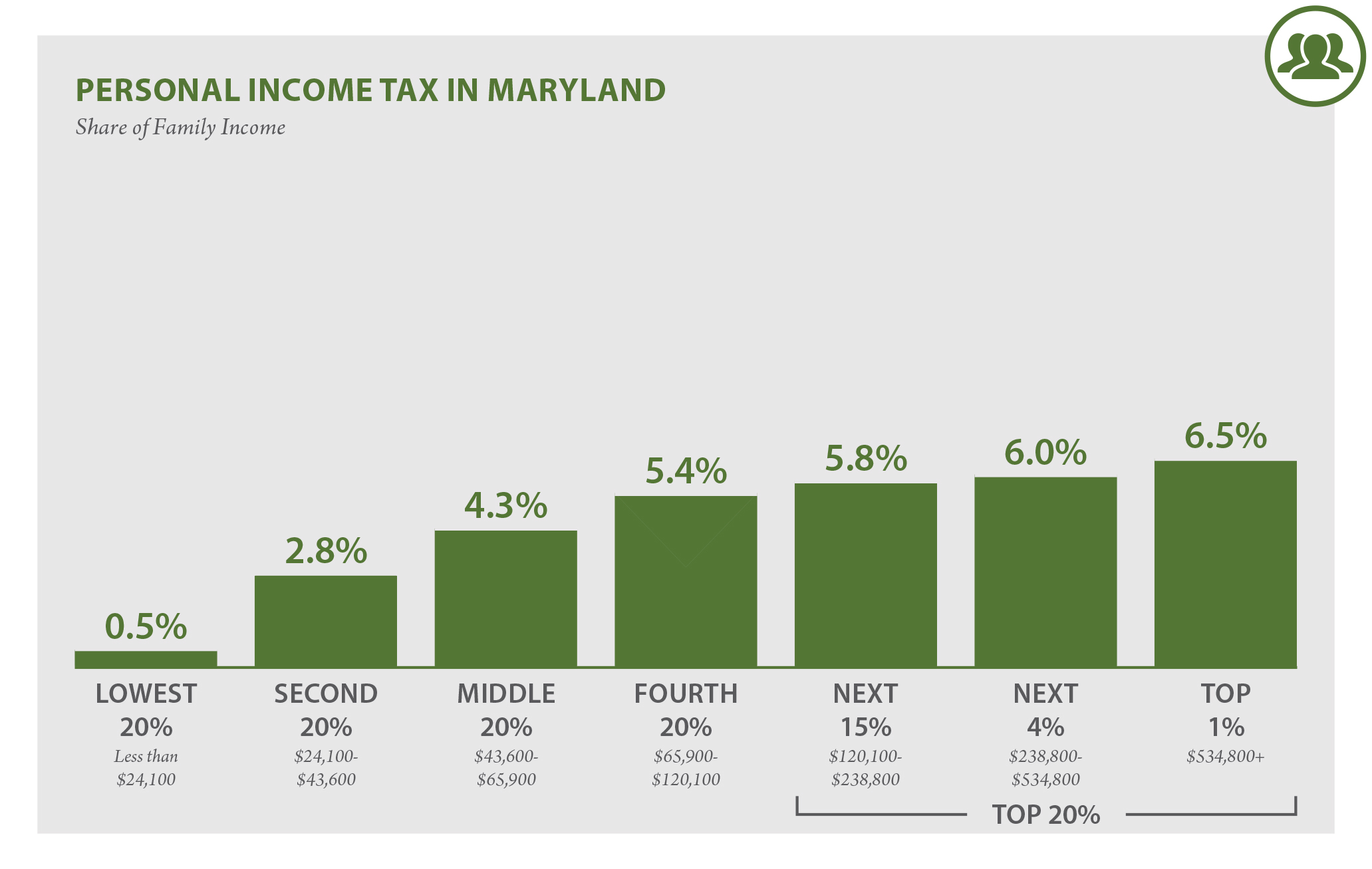

Maryland Who Pays 6th Edition Itep

If You Are A Maryland Resident Maryland Resident Income Tax

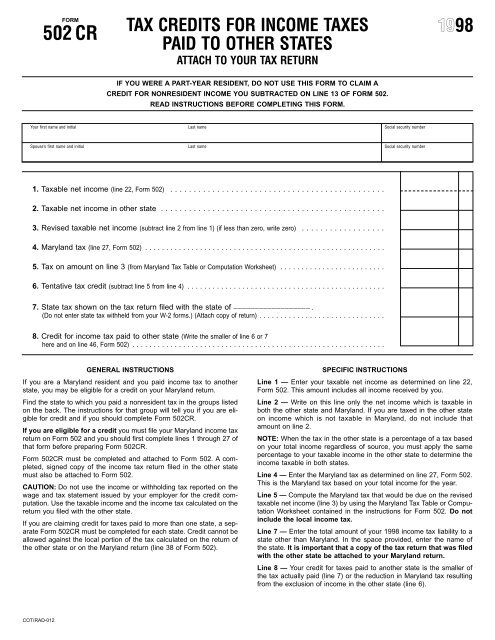

Tax Credits For Income Taxes Paid To Other States

Maryland Who Pays 6th Edition Itep

Maryland State 2022 Taxes Forbes Advisor

Tax Day Our Shared Investments In Maryland Maryland Center On Economic Policy

Maryland Who Pays 6th Edition Itep

Tax Deductions Families Can Claim For Dependents 2020 2021 Tax Deductions Deduction Income Tax

Institute On Taxation Economic Policy Finds Maryland Asks More Of Low And Middle Income Taxpayers Still Ranks Maryland Highly Compared To Other States Maryland Center On Economic Policy

Maryland State Tax Deadline Is July 15 2021 Wusa9 Com

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Pin On Maryland Estate Planning

What Can Maryland Do If I Owe Taxes

How Do State And Local Individual Income Taxes Work Tax Policy Center

Maryland Who Pays 6th Edition Itep

More Top Irs Audit Triggers To Avoid Irs Infographic Audit

Received A Notive Of Adjustment To Maryland Income Tax Return Don T Have Any Idea What Any Of It Means R Tax