what is maryland earned income credit

You may claim the EITC if your income is low- to. The Earned Income Tax Credit also known as EITC or EIC is a benefit designed to support low- to moderate-income working people.

What You Need To Know About The Mortgage Process Infographic Mortgage Infographic Mortgage Process Mortgage Loans

50954 56844 married filing jointly with three or more qualifying children 47440 53330.

. Some taxpayers may even qualify for a refundable Maryland EITC. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

IFile 2020 - Help. It can reduce your federal taxes possibly to zero. March 2 2021 Print.

R allowed the bill to take effect without his signature. Governor Larry Hogan R allowed the. Taxpayers can claim either but not both.

In Maryland stimulus checks have begun going out to lower-income people who are US. In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state-level EITC. What is the Earned Income Credit.

By design it is meant to benefit working families more than workers without children who qualify for the EITC credit. Eligibility and credit amount depends on your income family size and other factors. Find out what to do.

An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. Ranges from 25 to 45 percent of federal. You may qualify for extra cash back from the IRS.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit. Did you receive a letter from the IRS about the EITC.

The earned income tax credit is praised by both parties for lifting people out of poverty. Earned Income Tax Credit. Earned Income Tax Credit The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

2021 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide on or before December 31 2021 electronic. The local EITC reduces the amount of county tax you owe. Earned Income Credit - EIC.

Allowable Maryland credit is up to one-half of the federal credit. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. It provides a financial boost to working individuals and families.

AMaryland has temporarily raised the refundable state EITC to 45 for tax year beginning after December 31 2019 but before January 1 2023 at which point it shall revert back to 28. The Earned Income Tax Credit is a commonsense tax break that helps people who work but struggle to get by due to low wages and also boosts the economy. The state EITC reduces the amount of Maryland tax you owe.

The program is administered by the Internal Revenue Service IRS and is a major anti-poverty initiative. Earned Income Tax Credit or EITC also called as EIC is an important benefit for working people who have low to moderate income. It is a special program for low and moderate-income persons who have been employed in the last tax year.

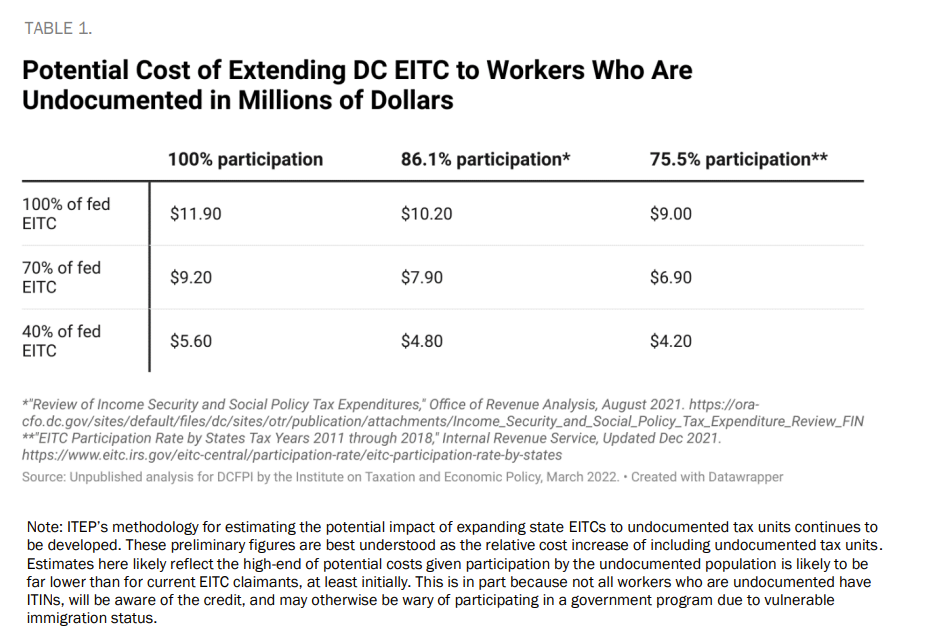

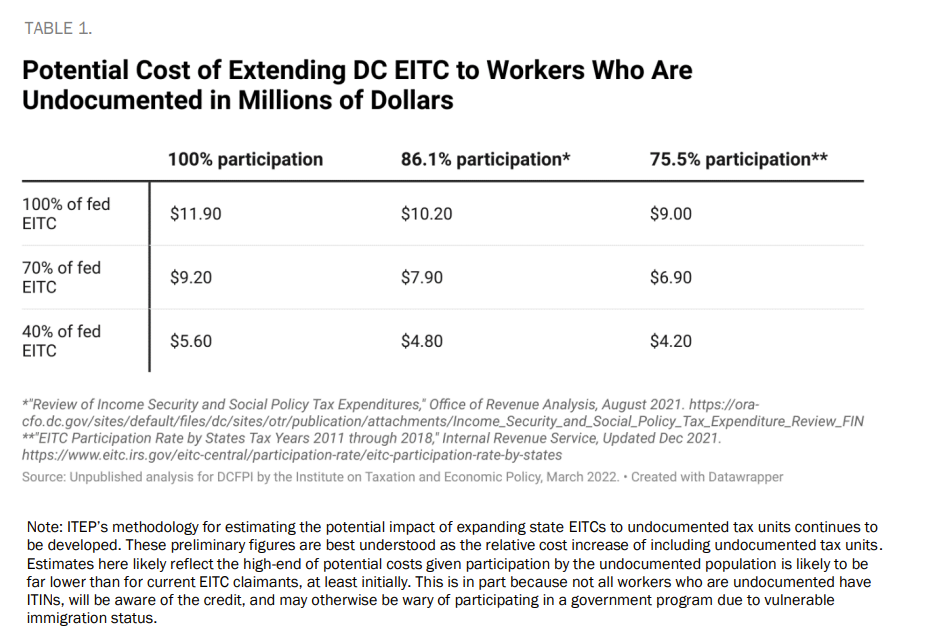

Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. That group of.

Maryland offers tax deductions and credits to reduce your tax liability including a standard deduction itemized. Updated on 4152021 to include changes for Relief Act 2021. It helps reduce the amount owed on taxes and can even result in a refund.

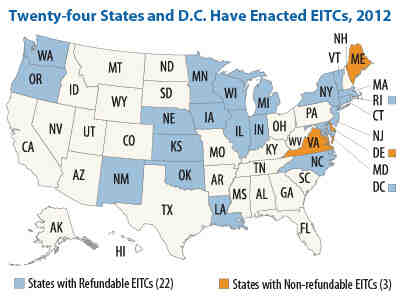

States and Local Governments with Earned Income Tax Credit States and Local Governments with Earned Income Tax Credit More In Credits Deductions. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. The non-refundable credit is equal to the lesser of 50 of the federal credit or the state income tax liability in the taxable year.

Calculate your federal EITC. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021.

If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but for you or your spouse filing with an individual taxpayer identification. The state income tax rates range from 2 to 575 and the sales tax rate is 6. Earned Income Credit EIC is a tax credit in the United States which benefits certain taxpayers who have low incomes from work in a particular tax year.

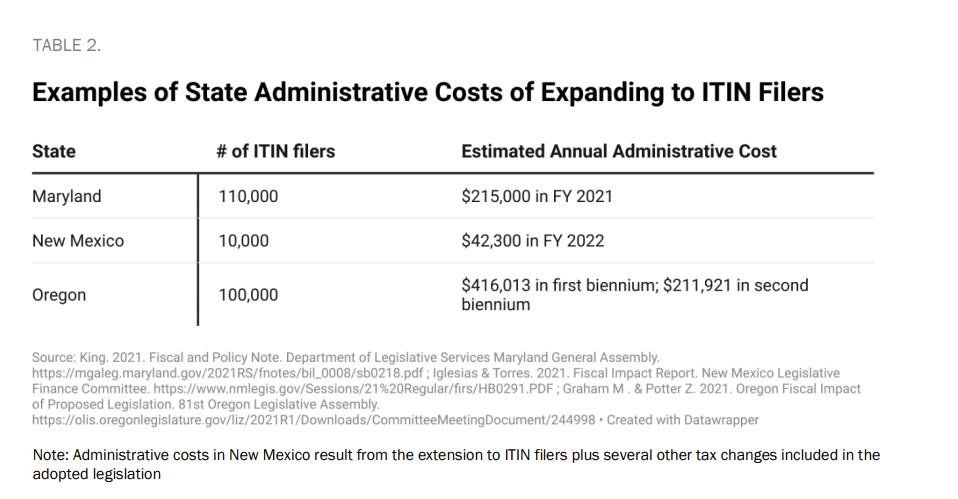

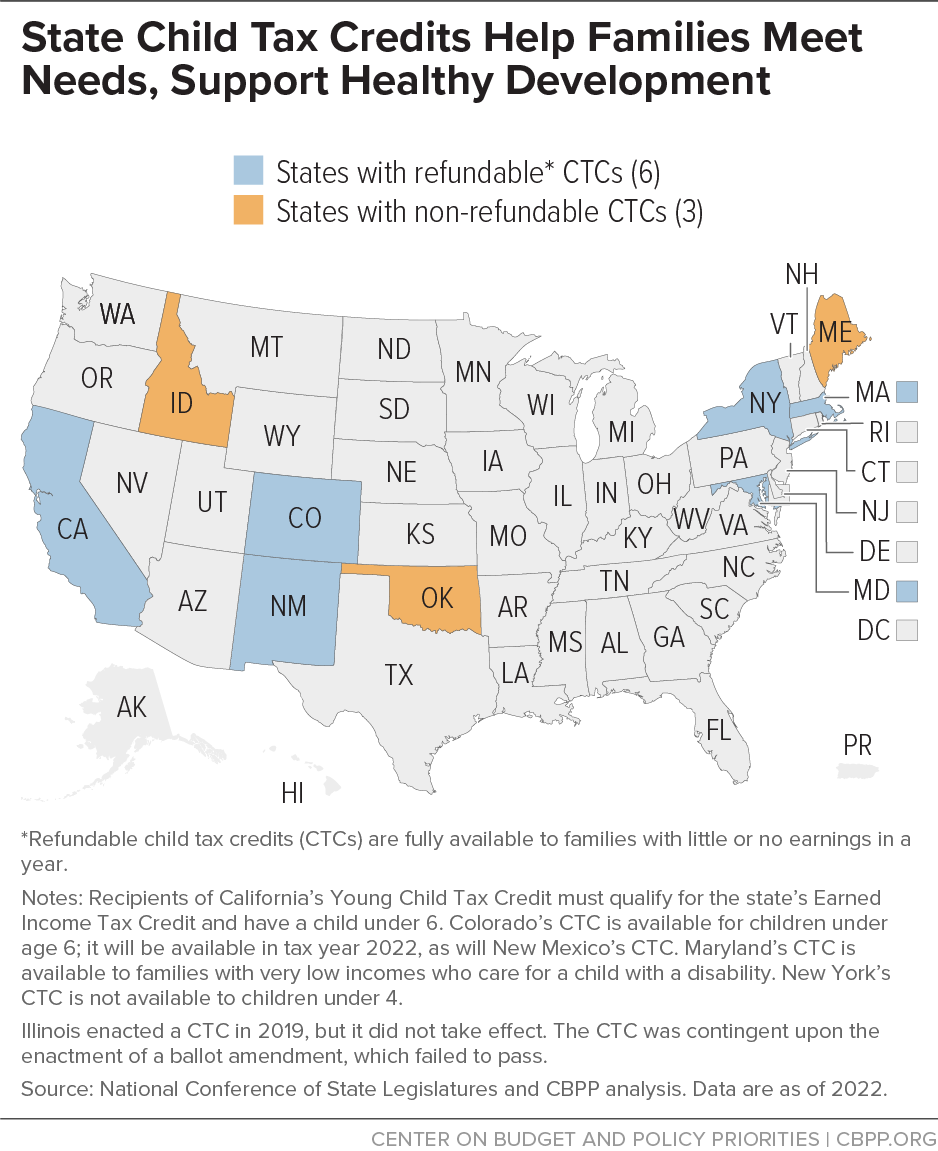

However Marylands credit isnt as effective as it could be for workers who arent raising children. Last week the Maryland General Assembly passed legislation to expand the state Earned Income Tax Credit EITC to taxpayers using Individual Taxpayer Identification Numbers ITINs and create a state Child Tax Credit for families earning 6000 or less with a child with disabilities. The State of Maryland pledges to provide constituents businesses customers and stakeholders with friendly and courteous timely and responsive accurate and consistent accessible and.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. The EIC is a refundable credit enacted as a work incentive in the Tax Reduction Act of 1975. BMinnesota law sets the Working Families Credit based on income.

To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following. See Marylands EITC information page. Maryland also offers a 50 nonrefundable EITC.

It has become one of the primary forms of public. The maximum federal credit is 6728. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

How To Get Up To 3 600 Per Child In Tax Credit Ktla

How Older Adults Can Benefit From The Earned Income Tax Credit

Earned Income Tax Credit Who Qualifies Changes For 2022

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

More And More Start Up Swipe 100 Reliable Profit Is Sent Daily Happy Wednesday Nbsp Nbsp Antiminers9 Nbsp Nbsp Nbsp Nbsp Bit

How Do State Earned Income Tax Credits Work Tax Policy Center

Pin On Villages Of Urbana Homes For Sale

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Earned Income Tax Credit Now Available To Seniors Without Dependents

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

An Orange County Shareholder Disputes Lawyer Can Provide Assistance In Situations Where Co Own Funny Marriage Advice Marriage Advice Cards Best Marriage Advice

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Summary Of Eitc Letters Notices H R Block

Child Tax Credit Schedule 8812 H R Block

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep